WEEKLY BUDGET TEMPLATE GOOGLE SHEETS FREE

Mint is a completely free app that completely changed budgeting when it debuted in 2006. Start budgeting the right way with You Need a Budget. Check out what the Personal Capital dashboard looks like below. The dashboard is also much more detailed so I can see my entire financial life on one screen, including my budget. While Mint is a great spending and budget tracker, Personal Capital has a lot more features and allows me to also track my investing portfolio performance, as well as the strength of my investing strategy. You might be wondering why I’d choose to use both Mint and Personal Capital and the reason is that they both have different strengths. In addition to using Mint since 2010, I’ve also been using Personal Capital for just as long.

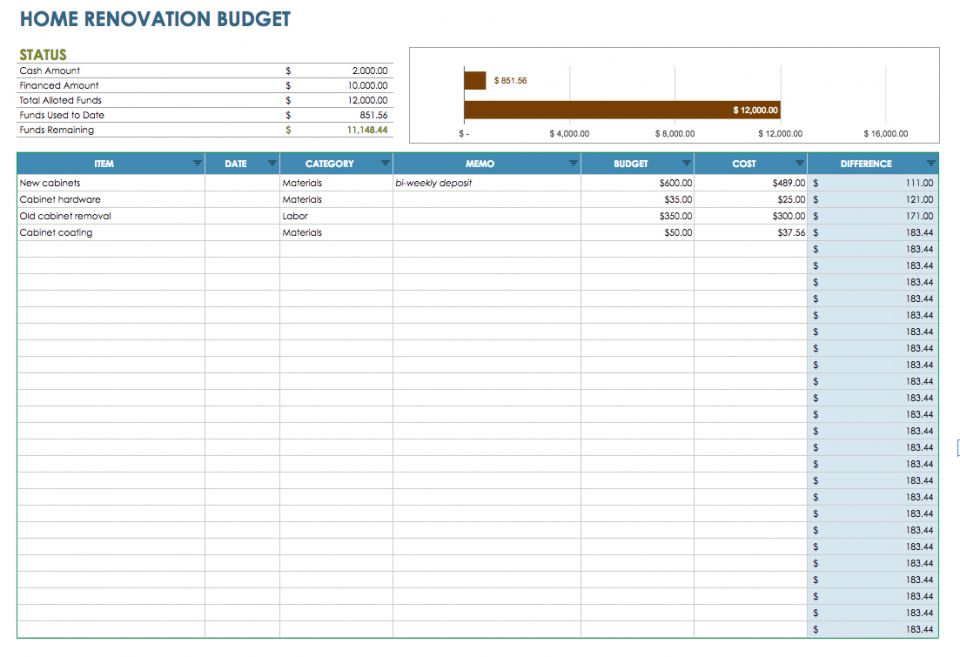

This is why I prefer to budget on my phone using a free budgeting tracking app. Life is so busy so I’m always looking for more efficient ways to manage my money. Free Budget Printable from A Mom’s Take.Here are the best budget templates for you to customize for your own needs: In This Article 7 Best Budget Templates and Tools No matter what budget method you choose, you want to find a way to budget you’re comfortable with so you’ll stick with it. No one method is better than another, so it’s important to try out different methods and pick the best method for you. There are four simple ways to set up a simple budget template: you can use a free budgeting app, a spreadsheet (with Google Docs or Excel), a paid budgeting tool, or good old pen and paper. I’ve spent the last month diving into all of the best budget templates so you don’t have to. This is why it’s important to find the best way for you to budget. There are many ways to budget and track how much money you’re making, spending, saving, and investing. But just like personal finance is personal, there’s no one size fits all budget template. 8+ Weekly Budget Templates 1.No matter where you are in your financial journey, budgeting is an essential money management tool. Our suggestion would be to use a bar graph. Use the type of chart that is better suited for the data that is being recorded here. When the data gets visually represented it makes easier to figure out where you need to cut corners. That is why it is advisable that you make use of graphs. Plain numbers take longer to make sense of. This way you can adjust your expenses when you have over-spent on something. You don’t have to calculate everything yourself. If you use the functional programming feature in Google Sheets, you can check the change in realtime. This is the difference between the amount of money that you have earned and that you have spent. In this section, the balance needs to be calculated. The last table should contain the difference between the previous two. The third one would be containing the actual amount that was getting used. The first one would be the ‘expenditure sources’ column and the second one would be the amount you had allocated for that particular usage. In the expenditure section, we are going to use similar columns as well. This is because we might be having some sources of passive income which might not always earn you the same amount. We are going to make an assumption of how much we will be making and write that alongside the actual amount. Write the headings as ‘income source,’ ‘estimated,’ ‘actual’ and ‘difference’ for the four columns that we are going to be using.

Since we are using a spreadsheet, we won’t be having to create tables separately. Combine the cells and increase the font size to make it look better. Write ‘Budget Planner’ as the title of the document.

WEEKLY BUDGET TEMPLATE GOOGLE SHEETS SOFTWARE

You can follow the steps irrespective of the software that you are using. You might use any other spreadsheet software that you feel comfortable with.

0 kommentar(er)

0 kommentar(er)